Subtitle: A Complete Guide to Secure and Smart Crypto Transactions

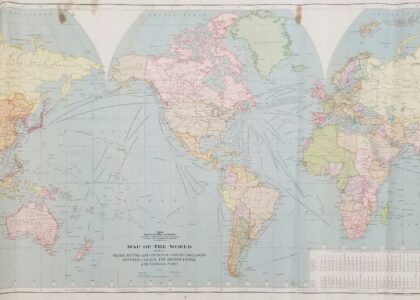

Cryptocurrency has moved from being a niche interest for tech-savvy individuals to becoming a mainstream financial revolution. Today, millions of people worldwide buy, sell, and trade digital currencies like Bitcoin, Ethereum, and countless altcoins. Whether you are an investor looking to diversify your portfolio, a trader seeking daily profits, or simply curious about digital finance, entering the crypto market can be both rewarding and intimidating.

But with opportunity comes risk. Stories of hacked exchanges, stolen wallets, scams, and costly mistakes highlight one fundamental truth: cryptocurrency must be handled with safety and strategy in mind. Unlike banks or traditional financial institutions, cryptocurrency transactions are irreversible—once your funds are gone, they are gone for good.Cryptocurrency has revolutionized the financial world. From the first Bitcoin transaction in 2009 to the bustling marketplace of thousands of altcoins in 2025, crypto has gone from a niche experiment to a trillion-dollar global industry. It offers the chance to invest, trade, and transact outside traditional banks, giving people control over their own money.

But with great opportunities come great risks. Every day, new investors fall victim to scams, hacks, and poor decision-making. From fake exchanges to phishing scams, the crypto world can be dangerous if you don’t know what you’re doing.

i- Understanding the Basics of Cryptocurrency

Before diving into buying and trading, it’s important to know what cryptocurrency really is.

Definition: A cryptocurrency is a digital or virtual form of money secured by cryptography. Unlike traditional currencies, it is decentralized and operates on blockchain technology.

Blockchain: A distributed digital ledger where transactions are recorded permanently and transparently.

Coins vs. Tokens:

Coins (like Bitcoin, Ethereum) usually have their own blockchain.

Tokens are built on existing blockchains and can represent various assets or utilities.

Why It Matters for Safety: Knowing how crypto works will help you understand why security is critical. Unlike a bank account, your cryptocurrency is only as safe as the measures you put in place.

ii- Preparing to Enter the Cryptocurrency Market

Pre-Investment Considerations

Before diving into cryptocurrency investments, consider the following:

- Risk Tolerance Assessment

- Understand your financial situation

- Determine how much you can afford to invest

- Never invest more than you can afford to lose

- Educational Preparation

- Study blockchain technology

- Learn about different cryptocurrencies

- Understand market dynamics

- Follow reputable cryptocurrency news sources

- Financial Goals

- Short-term trading

- Long-term investment

- Diversification strategy

- Potential passive income generation

iii- Choosing a Safe Platform to Buy Cryptocurrency

The first step in your crypto journey is deciding where to buy. There are three common ways:

A. Centralized Exchanges (CEXs)

Examples: Binance, Coinbase, Kraken.

- Pros: Easy to use, fast transactions, supports fiat-to-crypto purchases.

- Cons: You don’t fully own your coins unless you transfer them to a personal wallet. Exchanges can be hacked.

B. Decentralized Exchanges (DEXs)

Examples: Uniswap, PancakeSwap.

- Pros: No middlemen, you control your funds, privacy-focused.

- Cons: Complex for beginners, sometimes higher fees.

C. Peer-to-Peer (P2P) Platforms

Examples: LocalBitcoins, Binance P2P.

- Pros: Buy directly from individuals, multiple payment methods.

- Cons: Risk of scams if platform doesn’t have strong escrow protection.

iv- Setting Up a Secure Wallet

Not your keys, not your coins” is a golden rule in cryptocurrency.

Types of Wallets

a- Hot Wallets (software-based, connected to the internet)

- Examples: MetaMask, Trust Wallet.

- Pros: Easy access, great for trading.

- Cons: More vulnerable to hacking.

b- Cold Wallets (offline storage)

- Examples: Ledger, Trezor hardware wallets.

- Pros: Extremely secure.

- Cons: Costs money, less convenient.

c- Paper Wallets

- Printed private/public keys.

- Pros: No hacking risk.

- Cons: Can be lost or damaged.

v- How to Buy Cryptocurrency Safely

Here’s a step-by-step process:

- Choose a Secure Exchange → Look for one with good reputation, compliance, and security measures.

- Verify Your Account → Many exchanges require KYC (Know Your Customer).

- Secure Your Login → Use strong passwords, enable 2FA.

- Deposit Funds → Transfer fiat money (USD, PKR, EUR, etc.) or use credit/debit cards depending on exchange.

- Purchase Cryptocurrency → Select your desired coin (Bitcoin, Ethereum, etc.).

- Transfer to Wallet → Don’t leave large amounts on exchanges.

vi- Trading Cryptocurrency Safely

Trading is different from simply buying and holding. It involves strategies like day trading, swing trading, or scalping.

Golden Rules for Safe Trading

- Start Small: Don’t invest more than you can afford to lose.

- Use Stop-Loss Orders: Protects you from heavy losses.

- Diversify: Don’t put all your money into one coin.

- Avoid Over-Leverage: Margin trading can amplify both profits and losses.

- Research Projects: Always study coins before investing.

Cryptocurrency is more than just a trend—it’s a transformative financial system. However, the same qualities that make it exciting also make it risky. Without banks or governments acting as safety nets, your security lies in your own hands.Buying, selling, and trading cryptocurrency safely is all about knowledge, discipline, and security. By choosing regulated exchanges, securing your wallets, avoiding scams, and following best practices, you can confidently participate in the crypto market without unnecessary risks.Navigating the cryptocurrency market requires continuous learning, strategic thinking, and disciplined approach. By understanding fundamental principles, implementing robust security measures, and maintaining a balanced perspective, you can explore this exciting financial frontier safely and potentially profitably.

Cryptocurrency represents a revolutionary approach to finance, offering unprecedented opportunities for investment and technological innovation. However, success demands education, caution, and adaptability.

FAQ’s

Q1: What is the safest way to buy cryptocurrency?

Through a reputable, regulated exchange with strong security measures, then transferring to a cold wallet.

Q2: Should I leave my coins on an exchange?

No. Exchanges are targets for hackers. Always move funds to your personal wallet.

Q3: Can cryptocurrency transactions be reversed?

No. Once sent, they are final. Always double-check addresses.

Q4: Can cryptocurrency be hacked?

While blockchain technology is secure, exchanges and individual wallets can be vulnerable. Implementing strong security measures is crucial.

Q5: What is the best cryptocurrency to invest in?

There’s no universal “best” cryptocurrency. Bitcoin and Ethereum are most established, but diversification and personal research are key.

Meta Description

Learn how to buy, sell, and trade cryptocurrency safely with this ultimate guide. Discover secure platforms, wallets, strategies, and tips to protect your digital assets in 2025 and beyond.