Exploring Innovations That Are Redefining Money, Banking, and Global Trade

Over the past decade, blockchain has evolved from a niche technology powering Bitcoin into a transformative force across industries. Its impact on finance, in particular, has been nothing short of revolutionary. What started as a decentralized payment network is now shaping the foundations of banking, investing, lending, trading, and even regulatory compliance.

The rise of decentralized finance (DeFi), central bank digital currencies (CBDCs), tokenized assets, and Web3 has positioned blockchain at the center of the next financial revolution. As traditional financial institutions adapt to these innovations, the line between old and new finance continues to blur. Explore cutting-edge blockchain trends revolutionizing finance. Discover how decentralized technologies are reshaping banking, investments, and economic systems through innovative technological breakthroughs.

Introduction:

The financial landscape stands on the precipice of a technological revolution, with blockchain emerging as the most transformative force since the invention of digital banking. What began as a radical concept with Bitcoin in 2009 has evolved into a sophisticated ecosystem of technologies that promise to redesign fundamental economic structures, challenge traditional financial intermediaries, and create unprecedented opportunities for global economic participation.

This comprehensive analysis will dive deep into the most influential blockchain trends that are not just incrementally changing finance, but fundamentally reimagining how financial systems operate, interact, and create value in the 21st century.

i- Central Bank Digital Currencies

The State Joins the Game.Governments worldwide are experimenting with CBDCs — digital currencies issued and backed by central banks.

- China’s Digital Yuan: Already in pilot phases across multiple provinces.

- EU and US Plans: The European Central Bank is exploring a digital euro, while the US is considering a digital dollar.

- Impact: Faster payments, reduced costs, and more efficient monetary policy.

- CBDCs will bring blockchain into mainstream finance but may also challenge decentralized cryptocurrencies.

ii- Tokenization of Real-World Assets

Blockchain enables the tokenization of assets like stocks, bonds, real estate, and even art.

- Benefits: Fractional ownership, 24/7 trading, and increased liquidity.

- Platforms: Polymath, Securitize, and Avalanche are leading in tokenized securities.

- Example: Real estate tokenization allows investors to buy fractions of property without traditional brokers.

- This trend is democratizing investments once reserved for wealthy individuals.

iii- Decentralized Finance

The New Financial Ecosystem.Core Characteristics:

- Permissionless financial systems

- Reduced intermediary dependencies

- Global accessibility

- 24/7 operational models

Key DeFi Applications:

a) Lending Platforms

- Peer-to-peer lending

- Algorithmic interest rates

- Collateralized borrowing

- Instant loan processing

b) Decentralized Exchanges

- Non-custodial trading

- Reduced transaction fees

- Enhanced privacy

- Global liquidity pools

c) Yield Farming

- Automated investment strategies

- Liquidity provision rewards

- Complex financial instruments

- Algorithmic profit generation

iv- Central Bank Digital Currencies

Global CBDC Development:

- Government-backed digital currencies

- Enhanced monetary policy control

- Reduced transaction costs

- Improved financial inclusion

- Country Implementation Status:

- China: Advanced pilot programs

- European Union: Comprehensive research

- United States: Exploratory stages

- Singapore: Progressive development

- Technological Advantages:

- Real-time transaction monitoring

- Reduced money laundering risks

- Enhanced economic data collection

- Streamlined cross-border transactions

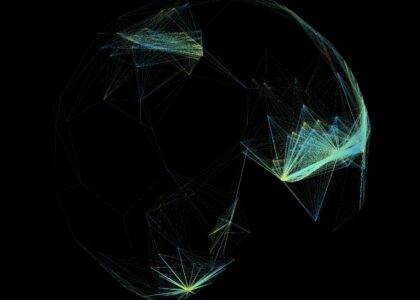

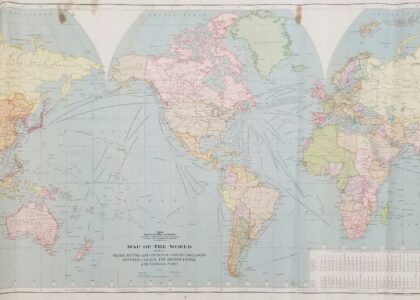

v- Blockchain in Cross-Border Payments

Traditional cross-border payments are slow and expensive. Blockchain provides instant, low-cost alternatives.

- Example: Ripple’s XRP Ledger enables near-instant settlement.

- Impact: Reduced remittance fees for developing countries.

- Future: Financial institutions adopting blockchain rails for global transfers.

vi- Green Blockchain and Sustainable Finance

Energy consumption has been a major criticism of blockchain, especially Bitcoin. The industry is shifting to eco-friendly solutions.

- Proof-of-Stake (PoS): Ethereum’s Merge reduced energy use by 99%.

- Green Projects: Algorand and Cardano emphasize sustainability.

- Impact: Aligns blockchain with ESG (Environmental, Social, Governance) investing.

Blockchain is no longer a buzzword — it’s the foundation of the next financial era. From DeFi and CBDCs to tokenization, stablecoins, and Web3, blockchain is reshaping how money moves, how assets are owned, and how financial systems operate.

The trends outlined in this guide show a clear direction: the future of finance will be decentralized, digitized, and democratized. Investors, institutions, and governments must adapt to these shifts or risk being left behind.

Blockchain is not just shaping the future of finance — it is the future of finance. Blockchain technologies represent more than a technological trend; they symbolize a fundamental reimagining of financial systems. By eliminating intermediaries, enhancing transparency, and creating unprecedented global economic accessibility, these technologies are laying the groundwork for a more inclusive, efficient, and innovative financial future.

The journey of blockchain is just beginning. As technologies mature, converge, and address current limitations, we can anticipate even more groundbreaking developments that will continue to reshape our understanding of money, value, and economic interaction.

FAQs

Q1: Which blockchain trend has the most potential?

DeFi and tokenization of assets have the largest long-term potential.

Q2: Are stablecoins safe to use?

Yes, but risks exist depending on the issuer’s reserves and regulations.

Q3: How will CBDCs affect crypto?

CBDCs may compete with stablecoins but also legitimize blockchain adoption.

Q4: What skills are needed to work in blockchain?

Recommended skills include programming, cryptography, cybersecurity, financial technology, and smart contract development.

Q5: How fast is blockchain technology evolving?

Blockchain is experiencing rapid development, with significant technological advancements occurring every 12-18 months.

Meta Description

Explore the top blockchain trends shaping the future of finance in this 6000+ word guide. Learn about DeFi, CBDCs, tokenization, stablecoins, NFTs, Web3, green blockchain, regulation, and institutional adoption.