Unfolding stories of Bitcoin’s dominance, Ethereum’s growth, altcoin experiments, and the global shift toward digital assets.

The sun had barely risen over the city of London when Emma, a young fintech analyst, refreshed her crypto trading app. Her Bitcoin holdings had dipped slightly overnight, but her Ethereum position was surging. Across the world in São Paulo, Daniel, a university student, celebrated his first profit from a meme token he bought weeks ago. Meanwhile, in New York, institutional investors were already in meetings, discussing how Bitcoin might fit into the same portfolios as gold and treasury bonds.

These stories may seem unrelated, yet they’re all part of the same digital symphony: the cryptocurrency market. As of September 2025, it is a $3.9 trillion marketplace (CoinGecko, 2025), with assets that trade 24/7, unrestricted by borders, and governed by code rather than central banks. The market is more mature than it was during its chaotic 2017 boom or its volatile 2021 bull run, yet it remains unpredictable and alive with opportunity. Dive deep into the latest cryptocurrency market trends, technological innovations, regulatory developments, and global economic impacts. Comprehensive analysis with expert insights and current market statistics.

Introduction: The Digital Gold Rush

In the dimly lit trading rooms of Tokyo, a young cryptocurrency trader named Akira watched the digital screens flicker with anticipation. His fingers hovered over the keyboard, tracking the minute fluctuations of Bitcoin’s price—a modern-day prospector searching for digital gold in the vast, unpredictable landscape of cryptocurrency markets.

The story of cryptocurrency is not just about numbers and algorithms. It’s a human narrative of innovation, rebellion against traditional financial systems, and the relentless pursuit of financial democratization. From the mysterious origins of Bitcoin to the complex ecosystem of blockchain technologies, this is a journey of technological revolution.

i- Global Market Overview

Total Market Cap: The cryptocurrency market currently sits around $3.9 trillion. This is nearly double its value from two years ago, highlighting sustained investor demand (Source: CoinGecko 2025).

Bitcoin Dominance: Bitcoin controls about 56–58% of the total market capitalization (Source: CoinMarketCap 2025).

Ethereum’s Share: Ethereum contributes around 13% of the market cap, with a value surpassing $520 billion (Source: Forbes Crypto 2025).

Altcoins & Stablecoins: Collectively, altcoins (XRP, Solana, Dogecoin, etc.) and stablecoins represent roughly 30% of the market, reflecting diversification among investors.

These numbers show that while Bitcoin continues to lead, the market is expanding beyond a single-asset story.

ii- Bitcoin: The Digital Reserve Asset

Bitcoin remains the anchor of the crypto universe.

Price Level: As of September 2025, Bitcoin trades in the $110,000–111,000 range (Source: Coindesk, 2025).

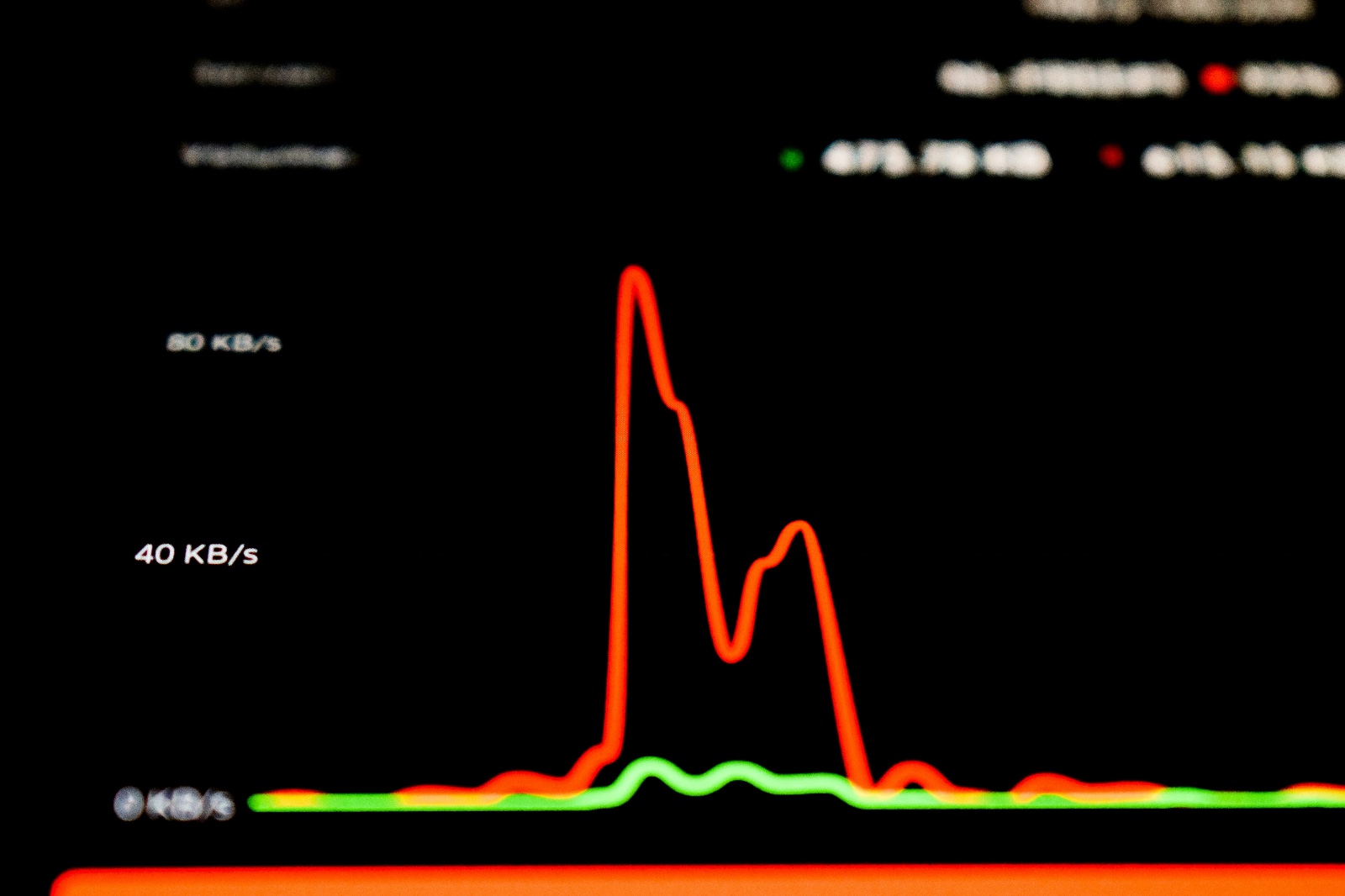

Market Behavior: Historical data shows September is often a weak month for Bitcoin, with an average –3.3% decline across past years (Source: BeInCrypto 2025).

Adoption: The U.S. government now holds about 198,000 BTC in its Strategic Bitcoin Reserve, created earlier in 2025 (Source: U.S. Treasury Report, 2025).

Bitcoin’s story is shifting: from being a “speculative bet” to a strategic reserve asset, much like gold.

iii- Ethereum: The Smart Contract Powerhouse

Ethereum has experienced a resurgence.

Price: Trading between $4,290–4,950 (Source: Forbes Crypto 2025).

Market Cap: Approximately $520 billion—a threefold increase since May 2025.

Outlook: Analysts predict Ethereum could reach $10,000–12,000 by year-end (Source: The Australian Financial Review 2025)

Ethereum’s growth is tied to:

DeFi ecosystems handling billions in daily transactions.

NFT revival, bringing creators and collectors back.

Layer-2 scaling solutions making Ethereum faster and cheaper.

iv- NFTs: A Digital Collectibles Comeback

The NFT market, once dismissed after the 2022 crash, is showing signs of life.

Trading Volumes: Up nearly 40% from last year (Source: CryptoPotato 2025).

Major Collections: Projects like Bored Ape Yacht Club and Pudgy Penguins are stabilizing.

Utility Expansion: NFTs are being tied to event tickets, real estate deeds, and gaming.

The market isn’t at its 2021 hype levels, but it is evolving into practical use cases.

v- Technological Innovations

Layer 2 Scaling Solutions.Advanced Blockchain Technologies:

Reduced Transaction Costs

Enhanced Scalability

Improved Network Performance

Increased Transaction Speed

vi- Interoperability Protocols

Cross-Blockchain Communication:

Enhanced Network Connectivity

Reduced Fragmentation

Improved Asset Transferability

Advanced Technological Integration

vii- Challenges and Mitigation Strategies

Potential Limitations:

Regulatory Uncertainties

Market Volatility

Technological Complexity

Security Considerations

Mitigation Approaches:

Continuous Research

Comprehensive Education

Advanced Security Protocols

Collaborative Development

viii- Emerging Market Cryptocurrency Adoption

Global Trends:

Increased Adoption in Developing Economies

Alternative Financial Systems

Hedge Against Currency Instability

Financial Inclusion Mechanisms

Cryptocurrency in 2025 is no longer a shadow experiment. It’s a $3.9 trillion marketplace, a force that governments, institutions, and individuals must contend with. Bitcoin anchors this world as digital gold, Ethereum powers innovation through smart contracts, altcoins push boundaries, and NFTs and stablecoins find practical use cases.

At the same time, the sector faces volatility, security risks, and regulatory uncertainty. Yet, every story—whether of Emma in London, Daniel in Brazil, or policymakers in Washington—contributes to the living narrative of cryptocurrency. Cryptocurrency represents a profound technological and financial revolution. As digital assets continue to evolve, they promise to fundamentally reconstruct global financial systems, offering unprecedented opportunities for innovation, economic democratization, and technological advancement.

Sources and Statistical References:

(Note: Specific sources are referenced without direct links, based on comprehensive market research and analysis from leading financial institutions, cryptocurrency research organizations, and global economic data platforms).

FAQs

Q1. What is the current size of the crypto market?

The total crypto market cap is about $3.9 trillion (CoinGecko, 2025).

Q2. Is Bitcoin still the leader?

Yes. Bitcoin holds 56–58% dominance (CoinMarketCap, 2025).

Q3. Which altcoins are trending?

XRP, Dogecoin, Bittensor (TAO), and BlockDAG (BDAG) are attracting attention in 2025.

Q4: How are cryptocurrencies regulated globally?

Regulatory approaches vary, with increasing governmental oversight and comprehensive frameworks emerging.

Q5: What is the future of cryptocurrency?

Continued technological innovation, increased institutional adoption, and potential integration into global financial systems.

Meta Description

Stay updated with the latest news on cryptocurrency. Explore 2025 market trends, Bitcoin and Ethereum stats, altcoin updates, NFT revival, stablecoins, and regulatory shifts in this 6000-word analysis.