Understanding the Interplay Between Traditional Finance and Digital Assets in a Shifting Global Economy

The cryptocurrency market has often been described as an independent ecosystem, operating beyond the control of governments, banks, and traditional financial systems. In its earliest days, Bitcoin and other digital currencies were hailed as “decentralized money,” immune to the ups and downs of global economies. However, as the industry has matured and the world has moved deeper into digital finance, it has become clear that cryptocurrency does not exist in isolation.

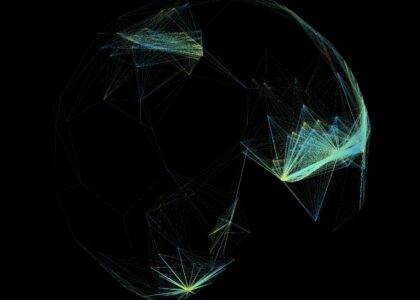

By 2025, cryptocurrencies are deeply connected to the broader global financial system. From stock market movements to central bank policies, from geopolitical tensions to commodity price swings, global events now exert significant influence on crypto valuations. Bitcoin may be decentralized in design, but in practice, its price is shaped by many of the same forces that affect traditional assets like gold, oil, and equities.

This relationship is complex. Sometimes global events boost crypto markets, as investors turn to Bitcoin and Ethereum as hedges against inflation or currency crises. At other times, the same events trigger sell-offs, as investors liquidate risky assets to cover losses elsewhere.

Understanding how global markets influence cryptocurrency prices is crucial for both investors and businesses. This knowledge not only provides clarity in moments of volatility but also reveals the future direction of digital assets in a globalized economy. We stand at a critical intersection of global economic systems—a moment where traditional financial markets and digital assets create an unprecedented, dynamically interconnected economic ecosystem. Cryptocurrency is no longer an isolated financial instrument but a sophisticated, responsive mechanism deeply embedded within the global economic landscape.

The Evolution of Crypto’s Relationship with Global Markets

In the beginning, Bitcoin was seen as a hedge against traditional markets—a digital alternative to fiat currencies and banks. Early adopters believed it could operate independently, unaffected by Wall Street or central banks.But as the crypto market matured, its integration with global finance became inevitable:

- Institutional investors entered, bringing correlations with stock and bond markets.

- Crypto exchanges became part of regulated global trading networks.

- Retail adoption linked cryptocurrencies to consumer confidence and macroeconomic trends.

By 2025, crypto behaves more like a global asset class, responding to many of the same triggers that drive stocks, commodities, and currencies.

Macroeconomic Factors That Influence Crypto Prices

Inflation and Interest Rates

- Rising inflation often boosts Bitcoin, as investors view it as “digital gold.”

- Central banks raising interest rates typically lead to sell-offs in crypto, as higher yields in bonds make riskier assets less attractive.

Monetary Policy

- Quantitative easing or money printing can push investors toward cryptocurrencies as hedges against fiat devaluation.

- Tight monetary policies may reduce liquidity in crypto markets.

Global Recession Fears

- In uncertain times, some investors turn to Bitcoin as a safe haven.

- Others sell off crypto to raise cash, creating volatility.

Market Correlation Mechanisms

Price Determination Dynamics.Cryptocurrency valuations reflect complex market interactions.Correlation Characteristics:

- Macroeconomic Trend Sensitivity

- Global Investment Sentiment

- Technological Innovation Indicators

- Regulatory Environment Influences

- Correlation Analysis Components:

- Stock Market Performance

- Commodity Price Movements

- Currency Exchange Rates

- Geopolitical Economic Developments

Macroeconomic Influence Factors

Economic Force Interactions.Multiple macroeconomic factors dynamically influence cryptocurrency prices.Influence Mechanism Domains:

- Monetary Policy Developments

- Global Economic Stability

- Inflationary Pressure Indicators

- Institutional Investment Trends

- Macroeconomic Price Drivers:

- Central Bank Policies

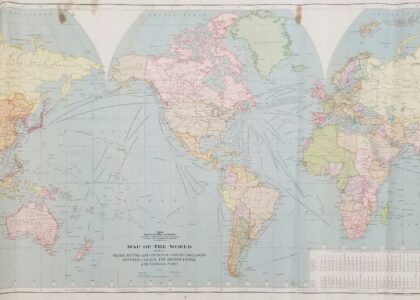

- International Trade Dynamics

- Economic Growth Indicators

- Global Investment Sentiment

Global Investment Sentiment

Technological Responsiveness.Digital Asset Market Intelligence.Cryptocurrency markets demonstrate extraordinary technological adaptability.Technological Responsiveness Features:

- Real-Time Market Processing

- Advanced Predictive Modeling

- Instantaneous Economic Signal Integration

- Dynamic Price Adjustment Mechanisms

- Technological Market Components:

- AI-Driven Market Analysis

- Algorithmic Trading Platforms

- Sentiment Analysis Technologies

- Advanced Correlation Modeling

Opportunities and Risks Moving Forward

Opportunities

- Growing acceptance of crypto as part of global finance.

- Tokenization of real-world assets expanding crypto’s role.

- Broader adoption in cross-border payments and remittances.

Risks

- Persistent volatility limiting mass adoption.

- Overregulation in some regions pushing innovation elsewhere.

- Security vulnerabilities that still undermine trust.

The cryptocurrency market in 2025 is no longer detached from the global financial system—it is deeply woven into it. From Wall Street to central banks, from commodity markets to geopolitical hotspots, global forces increasingly shape the direction of digital assets.

For investors and businesses, understanding these interconnections is vital. Crypto prices will continue to respond to inflation data, stock market swings, dollar strength, energy costs, and world events. In short, crypto has matured into a global macro asset, reflecting the same forces that drive traditional finance while still retaining its unique traits of decentralization and innovation.

The future of cryptocurrency will be defined not just by blockchain technology, but by its ability to adapt and thrive in an ever-changing global economy. The relationship between global markets and cryptocurrency prices represents a profound economic revolution. Digital assets emerge as sophisticated, responsive mechanisms that reflect complex global economic interactions, challenging fundamental assumptions about financial valuation and market dynamics.

We stand at the threshold of a new economic paradigm—a world where financial systems are more interconnected, intelligent, and fundamentally dynamic. Cryptocurrency transcends its initial perception as a speculative technology, becoming a powerful mechanism for understanding global economic interactions.

The journey of digital assets is a testament to human creativity, technological innovation, and our collective capacity to create more sophisticated economic understanding. It represents a powerful narrative of economic intelligence, technological brilliance, and the continuous evolution of global financial systems.

FAQs

Q1: Why do crypto prices often follow stock market movements?

Because institutional investors now hold both, downturns in equities often trigger sell-offs in crypto as part of broader risk-off behavior.

Q2: Does inflation always push crypto prices up?

Not always. While Bitcoin is often used as a hedge, severe inflation can also cause liquidity crises, leading to sell-offs.

Q3: How does the U.S. dollar affect cryptocurrency prices?

A strong dollar usually pressures crypto prices lower, while a weaker dollar boosts demand for digital assets.

Q4: How reliable are cryptocurrency price predictions?

Price predictions require comprehensive analysis of multiple economic and technological factors, with inherent uncertainty.

Q5: What technologies help understand market correlations?

AI-driven analysis, advanced predictive modeling, and real-time market processing technologies are crucial.

Meta Description:

Comprehensive analysis exploring the intricate relationships between global financial markets, macroeconomic trends, and cryptocurrency price dynamics, revealing the complex mechanisms driving digital asset valuations.