How Privacy Policies and Blockchain Principles Shape the Future of Digital Assets

The rise of cryptocurrency has not only revolutionized how we think about money but also reshaped the way we view privacy, transparency, and trust in the digital economy. Unlike traditional banking systems, where centralized institutions act as both gatekeepers and custodians of personal information, crypto introduced a paradigm shift: decentralization, peer-to-peer transactions, and user autonomy.

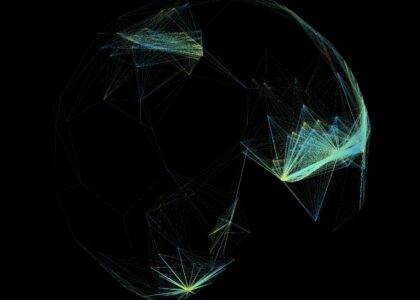

At the heart of this shift lies a powerful contradiction: blockchains are designed to be transparent, yet cryptocurrency users demand privacy. Every transaction made on most blockchains is permanently recorded on a public ledger, visible to anyone who chooses to look. Wallet addresses, transaction values, and histories are immutable, accessible, and resistant to tampering. This transparency builds trust and accountability. Yet, if transparency is absolute, where does individual privacy fit in?

This tension between privacy and transparency has become one of the defining debates in the crypto industry. On one hand, governments and regulators emphasize transparency to fight money laundering, fraud, and illicit activity. On the other hand, crypto enthusiasts and privacy advocates highlight that financial privacy is a human right — without it, personal freedom is compromised, and digital identity becomes vulnerable to exploitation.

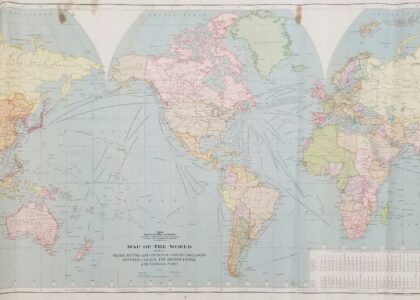

Today, as billions of dollars flow into digital assets, the importance of balancing privacy, transparency, and security cannot be overstated. Investors want to trust platforms with their data. Regulators demand accountability. Users want to ensure their financial lives aren’t open books for corporations, hackers, or authoritarian oversight. In the rapidly evolving landscape of digital finance, cryptocurrency represents more than just an alternative financial system – it is a revolutionary paradigm that challenges traditional notions of money, privacy, and financial sovereignty. The intersection of blockchain technology, cryptographic security, and personal privacy creates a complex and fascinating ecosystem that demands a nuanced understanding of digital financial interactions.

The genesis of cryptocurrency was rooted in a profound philosophical and technological vision: to create a financial system that transcends traditional institutional constraints, offering unprecedented levels of individual financial autonomy. Bitcoin, the first and most renowned cryptocurrency, emerged from a deep-seated desire to challenge centralized financial control, introducing a decentralized model that promised transparency, security, and individual empowerment.

However, the concept of privacy in cryptocurrency is far from straightforward. It represents a delicate balancing act between multiple competing priorities: the need for transparent, verifiable transactions; the protection of individual financial privacy; regulatory compliance; and the prevention of illicit activities. This complex interplay creates a dynamic and often controversial landscape that continues to evolve with technological advancements and regulatory developments.

Our exploration will delve deep into the multifaceted world of cryptocurrency privacy, examining the technological, philosophical, and practical dimensions that shape this revolutionary financial domain. We will unravel the intricate mechanisms that protect user identities, ensure transaction security, and maintain the fundamental principles of financial transparency.

The Foundations of Privacy in Crypto

i- Bitcoin’s Promise of Pseudonymity

When Bitcoin launched in 2009, it promised a financial system where users could transact without revealing personal identities. Wallets were represented by alphanumeric addresses rather than names. This pseudonymity gave users privacy while still ensuring transparency through a public blockchain.

ii- The Transparency Paradox

While wallet addresses don’t directly reveal identities, blockchain analytics firms and regulators can often trace transactions. For instance, if you use a centralized exchange that requires Know Your Customer (KYC) verification, your wallet becomes linked to your real-world identity. Transparency builds accountability, but it also opens the door to potential invasions of privacy.

iii- Privacy as a Human Right

In the digital economy, financial privacy is more than a luxury — it is a fundamental aspect of individual freedom. Without it, corporations and governments could monitor spending habits, behaviors, and affiliations, undermining autonomy.

Why Privacy Matters in the Crypto Ecosystem

i- Protecting Digital Assets

Hackers and malicious actors often target exposed wallets. When transaction data is public, wealthy wallets can be identified and exploited. Privacy ensures that digital assets are not easily traceable, reducing risks of theft.

ii- Preventing Surveillance Economies

Without privacy protections, crypto could evolve into a surveillance tool where governments or corporations monitor user activity. A strong emphasis on privacy policies prevents this dystopian outcome.

iii- Encouraging Trust in Platforms

Users are more likely to trade, invest, or store assets on platforms that are transparent about how they handle sensitive data. Privacy builds trust, which in turn fuels adoption.

Privacy Technologies in Crypto

i- Privacy Coins

Monero (XMR) uses ring signatures and stealth addresses to obscure transaction details.

Zcash (ZEC) employs zero-knowledge proofs (zk-SNARKs) to ensure transactions are valid without revealing specifics.

These coins prioritize privacy at the protocol level, unlike Bitcoin or Ethereum, where transparency is default.

ii- Layer-2 and Mixing Solutions

CoinJoin allows multiple Bitcoin users to combine transactions, making tracing difficult.

Lightning Network processes off-chain Bitcoin transactions, providing faster and more private settlements.

iii- Zero-Knowledge Proofs

Zero-knowledge cryptography is emerging as a breakthrough that balances transparency with privacy, allowing proofs of authenticity without revealing underlying data.

Challenges in Achieving Privacy in Crypto

i- Regulatory Pressure

Governments worldwide are tightening regulations on crypto platforms, requiring more identity verification and reporting. This reduces privacy but increases compliance.

ii- Cybersecurity Threats

Even platforms with strong privacy policies are vulnerable to hacks. Once data is leaked, it can rarely be retrieved.

iii- User Negligence

Many users fail to understand how their data is exposed. For instance, reusing wallet addresses or storing personal keys insecurely undermines privacy.

iv- Balancing Innovation and Law

The crypto industry walks a fine line between embracing cutting-edge privacy technologies and complying with laws aimed at preventing illicit activities.

Emerging Privacy Technologies

Future Privacy Innovations:

- Quantum-Resistant Cryptography

- Artificial Intelligence Privacy Filters

- Decentralized Identity Management

- Advanced Encryption Algorithms

- Technological Evolution Pathways:

- Machine Learning Privacy Optimization

- Adaptive Anonymity Protocols

- Comprehensive Threat Prediction

- Dynamic Security Adaptation

User Privacy Protection Mechanisms

Individual Privacy Empowerment:

- Granular Privacy Controls

- Anonymous Transaction Options

- Personal Data Protection

- Consent-Based Information Sharing

- Privacy User Experience Features:

- Intuitive Privacy Dashboards

- Customizable Anonymity Levels

- Transparent Tracking Mechanisms

- User-Controlled Information Exposure

Privacy in crypto is more than a feature — it is the foundation of trust, freedom, and adoption in digital finance. By striking a balance between transparency, security, and user rights, privacy empowers individuals while ensuring accountability across the ecosystem.

As blockchain continues to reshape global economies, platforms that prioritize privacy through both technology and clear policies will set the standard for a trustworthy digital future. Transparency without privacy leads to surveillance. Privacy without transparency leads to mistrust. The balance of the two defines the future of crypto.

In the end, privacy is not just about hiding — it is about protecting, empowering, and securing your digital life. Cryptocurrency privacy represents a dynamic and evolving ecosystem that sits at the intersection of technological innovation, individual rights, and financial transformation. The ongoing challenge lies in maintaining a delicate balance between transparency, security, and personal privacy.

As blockchain technologies continue to mature, privacy mechanisms will become increasingly sophisticated, offering users unprecedented levels of financial autonomy and identity protection. The future of cryptocurrency privacy is not about complete anonymity but about creating intelligent, adaptive systems that empower individuals while maintaining necessary levels of accountability.

The journey towards comprehensive cryptocurrency privacy is ongoing, driven by technological innovation, philosophical principles of individual sovereignty, and a collective commitment to reimagining financial interactions in the digital age.

FAQs

Q1: Isn’t blockchain already private by default?

No. Most blockchains are transparent ledgers. Privacy depends on how wallet addresses and transaction data are managed.

Q2: What are privacy coins, and are they legal?

Privacy coins like Monero and Zcash enhance anonymity. Their legality varies by jurisdiction — some countries restrict or ban them.

Q3: Why do exchanges still collect personal data if crypto is decentralized?

Because of regulatory compliance. Exchanges must adhere to KYC and AML laws to prevent illicit activity.

Q4: What are the primary privacy risks in cryptocurrency?

A: Potential risks include metadata exposure, transaction pattern analysis, and sophisticated tracking mechanisms.

Q5: How can users enhance their cryptocurrency privacy?

A: Users can utilize privacy-focused coins, implement advanced wallet security, and understand complex privacy mechanisms.

Meta Description

Explore Privacy in Crypto: Transparency, Security, and Trust — a deep dive into how digital assets balance openness with user protection. Learn how policies, technology, and trust shape the future of financial privacy.