Understanding How Digital Currencies Are Reshaping Global Finance, Trade, and Innovation

Over the last decade, the world has witnessed one of the most profound shifts in the history of money: the rise of cryptocurrency. What began in 2009 with Bitcoin as a small-scale experiment in peer-to-peer digital cash has now grown into a multi-trillion-dollar global industry that is rewriting the rules of finance, trade, and investment.

This journey is not just about numbers on a blockchain—it is about power, trust, and transformation. For centuries, the global economy has been shaped by the flow of traditional assets: gold, fiat currencies, government bonds, and stocks. These instruments relied on centralized systems—banks, clearing houses, and regulators—to operate. But cryptocurrencies disrupted that order by proposing a financial system that could function without central intermediaries, relying instead on mathematics, code, and consensus. The journey of crypto within the global economy is a dance between innovation and caution, progress and resistance, decentralization and control. We stand at a monumental crossroads of economic evolution—a transformative moment where cryptocurrency transcends its initial perception as a speculative technology and emerges as a fundamental mechanism of global economic redesign. This is not merely a technological trend but a profound revolution challenging fundamental assumptions about value, exchange, financial participation, and economic interaction.

The Birth of Crypto: A Response to Economic Uncertainty

Cryptocurrency did not emerge in a vacuum. Bitcoin was introduced in 2009, in the shadow of the 2008 global financial crisis. Trust in banks and centralized systems was shattered as governments bailed out failing institutions, leaving ordinary people to deal with the fallout.

Bitcoin’s whitepaper, authored by the mysterious Satoshi Nakamoto, proposed an alternative: a peer-to-peer electronic cash system where no central authority could manipulate supply, block transactions, or devalue currency through inflation.

This vision resonated strongly with communities disillusioned by the failures of traditional finance. Over time, it attracted developers, entrepreneurs, and investors who saw crypto not just as money, but as a movement towards financial sovereignty.

The Growth of Crypto Markets in the Global Economy

From Niche to Mainstream

In the early days, Bitcoin and altcoins were often dismissed as fads or tools for criminals. Fast forward to the 2020s, and crypto has become a mainstream financial asset.

- Institutional investors like hedge funds and asset managers now include Bitcoin and Ethereum in their portfolios.

- Major corporations accept cryptocurrencies for payments.

- Countries like El Salvador recognize Bitcoin as legal tender.

Market Capitalization and Trade Volumes

The crypto market grew from virtually zero in 2009 to a peak of over $3 trillion in 2021. While volatility has caused fluctuations, the overall trend demonstrates increasing integration into the global financial system.

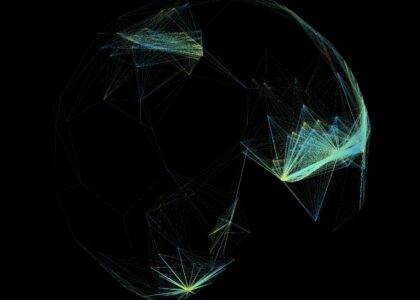

A Global Asset Class

Unlike traditional assets tied to geographic borders, crypto is a truly global asset class. A farmer in Kenya, a student in India, and a banker in London all have equal access, provided they have internet connectivity.

Opportunities Created by Crypto

Democratization of Finance

Crypto lowers barriers to entry, allowing anyone with internet access to participate in the global economy.

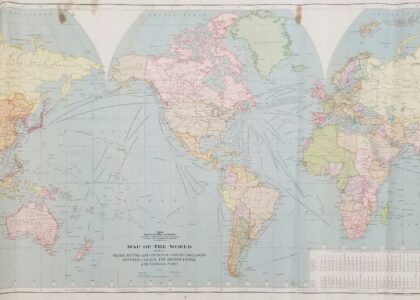

Global Trade Simplification

By bypassing banks, crypto reduces friction in international trade, enabling faster and cheaper settlement of transactions.

New Business Models

Startups raise capital through Initial Coin Offerings (ICOs) or Security Token Offerings (STOs), bypassing traditional venture capital.

Integration with Emerging Technologies

Crypto and blockchain intersect with AI, IoT, and the metaverse, creating next-generation digital economies.

Challenges and Risks

Regulatory Uncertainty

Governments worldwide are divided:

- Some, like Switzerland and Singapore, embrace crypto with clear frameworks.

- Others, like China, impose strict bans.

- This regulatory patchwork creates uncertainty for investors and businesses.

Volatility

Cryptocurrencies are highly volatile, with prices swinging dramatically. While attractive to traders, this makes them less reliable for everyday transactions.

Security Risks

From exchange hacks to phishing scams, security remains a major concern. Unlike banks, crypto transactions are often irreversible.

Energy Consumption

Bitcoin’s proof-of-work mining has been criticized for its environmental impact, sparking debates about sustainability.

Market Speculation

Excessive hype and speculative bubbles can lead to dramatic crashes, eroding trust in digital assets.

Economic Disruption Mechanisms

Cryptocurrency’s Transformative Economic Potential.Fundamental challenges to traditional economic systems.Disruption Characteristics:

- Decentralized Financial Mechanisms

- Reduced Intermediary Dependencies

- Global Economic Accessibility

- Transparent Value Exchange

- Disruption Domains:

- Traditional Banking Systems

- International Money Transfer

- Investment Mechanisms

- Economic Participation Models

Global Financial Implications

Reimagining Financial Interactions.Cryptocurrency’s profound impact on global financial systems.Financial Transformation Features:

- Borderless Economic Interactions

- Reduced Transaction Costs

- Enhanced Financial Accessibility

- Intelligent Economic Mechanisms

- Global Financial Impact:

- Democratized Investment Opportunities

- Transparent Economic Interactions

- Reduced Economic Barriers

- Intelligent Financial Infrastructure

The journey of cryptocurrency within the global economy is nothing short of transformative. From its roots in the aftermath of financial crisis to its current role as a global asset class, crypto has proven its potential to disrupt, empower, and redefine.

Opportunities for financial inclusion, faster trade, and innovation are vast, but so are the challenges of volatility, regulation, and sustainability. The future will be shaped not just by developers and investors, but also by policymakers, businesses, and ordinary citizens.

What is clear is that crypto is no longer a fringe experiment—it is a revolutionary force reshaping the global economy. The journey is far from over, but its impact will be felt for generations to come. Cryptocurrency’s journey through the global economic landscape represents a profound technological, economic, and social revolution. Digital economic mechanisms emerge as powerful tools for reimagining economic interactions, challenging fundamental assumptions about value, exchange, and financial participation.

We stand at the threshold of a new economic paradigm—a world where economic systems are more transparent, accessible, efficient, and fundamentally democratic. Cryptocurrency transcends its initial perception as a speculative technology, becoming a sophisticated mechanism for economic transformation and technological innovation.

The journey of cryptocurrency in the global economy is a testament to human creativity, technological brilliance, and our collective capacity to challenge existing economic systems. It represents a powerful narrative of economic empowerment, technological innovation, and the continuous evolution of human economic interaction.

FAQs

Q1: How does crypto impact the global economy?

It enables financial inclusion, reshapes cross-border trade, creates new investment opportunities, and drives innovation.

Q2: Why do some countries embrace crypto while others ban it?

Countries with strong financial systems may see crypto as a threat, while those with unstable currencies may see it as a solution.

Q3: What technologies drive cryptocurrency’s economic potential?

Blockchain, cryptography, distributed networks, and intelligent transaction systems are primary technological drivers.

Q4: What are the primary challenges in cryptocurrency’s economic integration?

Regulatory uncertainty, technological complexity, public perception, and systemic resistance remain key challenges.

Q5: How might cryptocurrency transform economic participation?

By reducing barriers, enabling global access, and introducing more transparent, efficient economic mechanisms.

Meta Description:

Comprehensive exploration of cryptocurrency’s profound impact on global economic systems, analyzing technological innovations, systemic transformations, and the future of decentralized economic interactions.