Exploring the Promise and Pitfalls of Digital Currency in a Rapidly Changing World

When Bitcoin was first introduced in 2009, few could have predicted how quickly cryptocurrencies would become a central topic in global finance. Initially dismissed as an experiment for tech enthusiasts and libertarians, crypto has since evolved into a trillion-dollar industry, capturing the attention of governments, businesses, investors, and everyday citizens. By 2025, cryptocurrencies are no longer a fringe idea — they are at the heart of conversations about the future of money, digital innovation, and financial inclusivity.

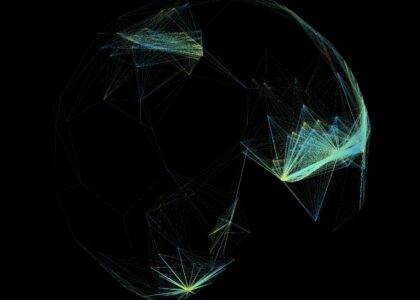

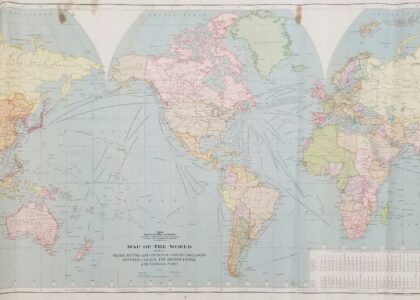

Global adoption of cryptocurrency is accelerating at an unprecedented pace. From Silicon Valley startups to small businesses in Africa, from government-backed initiatives in Asia to individual investors in Latin America, crypto has found a role in nearly every corner of the world. For some, it is a hedge against inflation; for others, it is a solution to broken financial systems. For institutions, it represents an entirely new asset class with untapped potential.

Yet, this rapid adoption comes with both tremendous opportunities and daunting challenges. The potential of crypto to reshape global finance is undeniable, but so are the risks of volatility, regulatory uncertainty, technological limitations, and misuse. Countries across the globe are experimenting with different approaches, with some embracing digital assets as innovation drivers, while others impose strict bans out of caution. We stand at a pivotal moment in technological and economic evolution—a transformative era where cryptocurrency transitions from a speculative technology to a fundamental mechanism of global economic interaction. The journey of global crypto adoption represents a complex, multifaceted narrative of technological innovation, economic transformation, and societal reimagination.

The Current State of Global Crypto Adoption

- Cryptocurrency adoption is no longer limited to tech-savvy individuals. It has become a global financial movement.

- Retail adoption is rising rapidly, with millions using crypto wallets for payments, savings, and remittances.

- Institutional investors have begun integrating Bitcoin, Ethereum, and other assets into their portfolios.

- Governments are experimenting with Central Bank Digital Currencies (CBDCs) and regulatory frameworks.

According to recent studies, emerging economies often lead in adoption rates, largely due to inflationary pressures, currency devaluations, and limited access to traditional banking. Countries like Nigeria, Vietnam, Argentina, and Turkey are among the global leaders in crypto adoption, proving that digital assets are not just a Western phenomenon but a truly global financial shift.

Opportunities Driving Global Crypto Adoption

i- Financial Inclusion

Billions of people worldwide remain unbanked or underbanked. Cryptocurrencies offer a gateway to financial systems, enabling access to savings, loans, and payments without the need for traditional banks.

ii- Cross-Border Payments and Remittances

Remittances are often plagued by high fees and delays. Crypto provides a faster and cheaper alternative, helping migrant workers send money home instantly with minimal charges.

iii- Hedge Against Inflation

In economies suffering from hyperinflation, cryptocurrencies like Bitcoin serve as stores of value when local currencies lose purchasing power.

iv- Innovation in Business and Commerce

From NFTs and DeFi to tokenized assets, crypto fuels innovation in finance, art, gaming, and commerce. Businesses are adopting blockchain solutions to streamline operations and reduce costs.

v- Investment Opportunities

Crypto offers retail and institutional investors exposure to high-growth assets, portfolio diversification, and new forms of wealth generation.

Adoption Challenges

Barriers to Widespread Integration.Complex factors impeding global cryptocurrency adoption.Challenge Categories:

- Technological Complexity

- Regulatory Uncertainty

- Public Perception

- Infrastructure Limitations

- Economic Volatility

- Mitigation Strategies:

- User-Friendly Interfaces

- Comprehensive Education

- Regulatory Clarity

- Technological Simplification

- Risk Management Mechanisms

Regulatory Frameworks

Global Regulatory Landscape.Diverse approaches to cryptocurrency regulation.Regulatory Perspectives:

- Comprehensive Legal Frameworks

- Consumer Protection Mechanisms

- Taxation Strategies

- International Regulatory Cooperation

- Regulatory Trend Analysis:

- Standardized Compliance Requirements

- Institutional Engagement Guidelines

- Transparent Reporting Mechanisms

- Global Regulatory Harmonization

Economic Implications

Transformative Economic Potential.Cryptocurrency introduces profound economic possibilities.Economic Transformation Domains:

- Financial Inclusion

- Decentralized Economic Networks

- Alternative Investment Mechanisms

- Global Value Exchange

- Potential Economic Impact:

- Reduced Transaction Costs

- Enhanced Economic Accessibility

- Transparent Financial Mechanisms

- Borderless Economic Participation

The Future of Global Crypto Adoption

Looking ahead, the trajectory of crypto adoption will depend on several factors:

- Clear regulations that encourage innovation while protecting consumers.

- Technological improvements, such as scalable blockchains and sustainable consensus mechanisms.

- Broader institutional participation, driving mainstream legitimacy.

- Consumer education and awareness to reduce skepticism.

- If these challenges are addressed, crypto could evolve from a speculative asset into a core pillar of the global financial system.

The story of global crypto adoption is still being written. What began as an experiment in decentralized money is now reshaping how we think about finance, innovation, and inclusivity. The opportunities are vast — from empowering the unbanked to revolutionizing payments — but the challenges are equally pressing, from volatility to regulation.

The future will not be without obstacles, but one thing is certain: crypto is no longer a passing trend. It is a force that will continue to transform economies, societies, and the global financial landscape in the years ahead. Global cryptocurrency adoption represents a profound technological, economic, and social revolution. Digital assets emerge as a powerful mechanism for reimagining economic interactions, challenging fundamental assumptions about financial systems, value exchange, and economic participation.

We stand at the threshold of a new economic paradigm—a world where financial systems are more transparent, accessible, efficient, and fundamentally democratic. Cryptocurrency transcends its initial perception as a speculative technology, becoming a powerful tool for economic transformation and technological innovation.

The journey of global crypto adoption is a testament to human creativity, technological brilliance, and our collective capacity to challenge existing economic systems. It represents a powerful narrative of economic empowerment, technological innovation, and the continuous evolution of human economic interaction.

FAQs

Q1: Why are emerging economies leading in crypto adoption?

Because many face inflation, currency instability, and lack of banking infrastructure, making crypto a practical alternative.

Q2: Will regulation help or hurt crypto adoption?

Clear and fair regulation can encourage adoption by providing legitimacy and consumer protection, while overly strict rules may stifle innovation.

Q3: Is cryptocurrency too volatile to be used as money?

Volatility is a challenge, but stablecoins and CBDCs are addressing this issue, making digital currencies more practical for everyday use.

Q4: How are governments responding to cryptocurrency?

Governments are developing increasingly sophisticated regulatory frameworks to address cryptocurrency integration.

Q5: What are the potential societal benefits of cryptocurrency?

Financial inclusion, economic democratization, and reduced economic barriers are significant potential benefits.

Meta Description:

Comprehensive exploration of global cryptocurrency adoption, analyzing technological innovations, regulatory landscapes, socioeconomic implications, and the complex challenges facing widespread digital asset integration.