Exploring the Growth, Challenges, and Future Possibilities of the Digital Asset Economy

The story of money has always been the story of progress. From the barter systems of ancient civilizations to gold-backed currencies, from paper notes to plastic cards, and now to digital assets, every leap in financial innovation has reflected humanity’s desire for efficiency, security, and freedom. Among these milestones, cryptocurrency represents one of the most transformative shifts of the modern era—a financial ecosystem that exists beyond borders, centralized institutions, and traditional frameworks of trust.

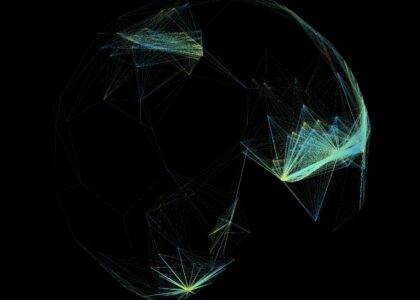

Over the last decade, cryptocurrencies have moved from fringe curiosity to mainstream discussion. What started with Bitcoin in 2009 as an experimental form of peer-to-peer cash has now evolved into a global marketplace valued in the trillions of dollars. Today, cryptocurrencies power not only speculative trading but also payments, decentralized finance (DeFi), cross-border remittances, and even governance through decentralized autonomous organizations (DAOs).

Yet, as the market has expanded, so too have the questions. How stable is the cryptocurrency ecosystem? Which trends are shaping its direction? Will regulation hinder or enhance growth? Can digital assets coexist with traditional banking and finance? Most importantly, what does the future hold for this rapidly evolving market? We stand at a pivotal moment in financial history—a transformative era where cryptocurrency transcends its initial perception as a speculative instrument and emerges as a fundamental mechanism of global economic transformation. This is not merely a technological trend but a profound revolution challenging traditional financial frameworks, democratizing economic participation, and reimagining value exchange.

Cryptocurrency Market Composition

The global cryptocurrency ecosystem demonstrates extraordinary complexity and potential.Market Characteristics:

- Total Market Capitalization

- Trading Volume

- Global Investor Participation

- Institutional Involvement

- Cryptocurrency Categories:

- A. Established Cryptocurrencies

- Bitcoin’s Market Dominance

- Ethereum’s Ecosystem

- Stable Coin Developments

- B. Emerging Digital Assets

- Layer 1 Blockchain Platforms

- Utility Tokens

- Governance Tokens

- Privacy-Focused Cryptocurrencies

Key Global Trends in Cryptocurrency

i- Institutional Adoption

Once dismissed as “speculative assets,” cryptocurrencies are now attracting hedge funds, banks, and even governments. Institutional adoption is driving:

- Greater market liquidity.

- The development of crypto-focused financial products (ETFs, futures, and custody services).

- A shift in perception from “risky speculation” to “alternative investment.”

ii- Regulatory Developments

Regulation is shaping the future of crypto worldwide. While some nations embrace digital assets, others impose strict controls. Key insights:

- Clear regulations tend to encourage adoption by reducing uncertainty.

- Over-regulation risks pushing innovation to friendlier jurisdictions.

- Global cooperation remains fragmented, leading to differing rules across countries.

iii- Rise of Central Bank Digital Currencies (CBDCs)

Many governments are exploring CBDCs to compete with cryptocurrencies. While CBDCs differ from decentralized crypto, their rise highlights:

- The mainstream recognition of digital money.

- A potential hybrid future where private crypto and public digital currencies coexist.

iv- DeFi and Financial Inclusion

DeFi continues to disrupt traditional finance by offering open access to loans, savings, and trading. Its promise:

- Greater financial inclusion for the unbanked.

- A decentralized alternative to banks.

- However, risks of hacks, scams, and liquidity issues remain.

v- Environmental and Technological Innovations

- The environmental debate around Bitcoin’s energy use has accelerated innovation. Ethereum’s transition to proof-of-stake, as well as growing adoption of green mining, signals a trend toward sustainability.

Market Insights: Understanding the Current Landscape

i- Market Size and Growth

The cryptocurrency market has experienced exponential growth, with trillions in market capitalization. Insights include:

- Bitcoin and Ethereum still dominate market share, but altcoins are gaining ground.

- Stablecoins have grown rapidly, often used in cross-border transactions.

- Institutional demand is reshaping market maturity.

ii- Investor Behavior

Crypto investors fall into distinct categories:

- Long-term holders (“HODLers”), who see crypto as digital gold.

- Active traders, capitalizing on volatility.

- Institutional players, using crypto as a hedge against inflation and market risk.

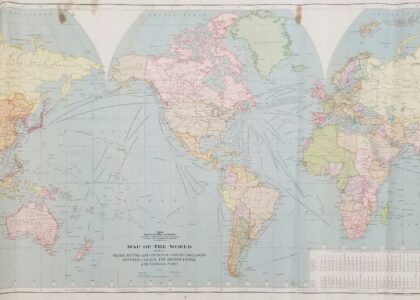

iii- Regional Adoption Patterns

- North America: Institutional focus and regulatory debates.

- Europe: Progressive regulation with growing fintech integration.

- Asia: Strong retail adoption, innovation hubs, and regulatory complexity.

- Africa and Latin America: Crypto as a solution to inflation and remittance costs.

Technological Innovations

Blockchain Technology Evolution.Continuous technological advancements reshape cryptocurrency infrastructures.Innovation Domains:

- Scalability Solutions

- Interoperability Protocols

- Consensus Mechanism Developments

- Advanced Cryptographic Techniques

- Technological Breakthroughs:

- Layer 2 Scaling Solutions

- Cross-Chain Communication

- Quantum-Resistant Architectures

- Sustainable Blockchain Networks

Regulatory Landscapes

Global Regulatory Approaches.Different jurisdictions develop nuanced cryptocurrency regulations.Regulatory Perspectives:

- United States Regulatory Framework

- European Union’s Comprehensive Approach

- Asian Market Regulations

- Emerging Market Cryptocurrency Policies

- Regulatory Trend Analysis:

- Compliance Requirements

- Consumer Protection Mechanisms

- Tax Implications

- Institutional Engagement Frameworks

Challenges Ahead

Despite growth, challenges remain:

- Volatility: Price swings deter mainstream adoption.

- Security risks: Hacks and scams undermine trust.

- Regulatory uncertainty: Uneven global rules create barriers.

- Technology scaling: Networks must handle higher transaction volumes.

- The ability of the crypto market to overcome these hurdles will define its trajectory.

The global cryptocurrency market stands at a critical juncture. What began as a fringe experiment has evolved into a transformational financial ecosystem influencing everything from payments to governance. With institutional adoption, regulatory progress, and innovations in DeFi and blockchain technology, cryptocurrencies are poised to remain central to the future of finance.

Yet, the path ahead is not without obstacles. Volatility, security concerns, and regulatory tensions could slow progress if not addressed. Still, the resilience of the crypto industry suggests that innovation will continue to outpace challenges.

The future of the global cryptocurrency market is not about replacing traditional finance—it’s about reinventing it, creating a system that is more inclusive, efficient, and adaptable to the digital age. The global cryptocurrency market represents a profound technological, economic, and social revolution. As digital assets become increasingly integrated into global financial infrastructures, they challenge fundamental assumptions about value, exchange, and economic interaction.

We stand at the threshold of a new economic paradigm—a world where financial systems are more transparent, accessible, and fundamentally democratic. Cryptocurrency is not merely a technological innovation but a powerful mechanism for reimagining economic possibilities.

The journey of digital assets is a testament to human creativity, technological innovation, and our collective capacity to challenge existing systems. It represents a powerful narrative of economic empowerment, technological brilliance, and the continuous evolution of human economic interaction.

FAQs

Q1: What is driving the growth of the global cryptocurrency market?

Institutional adoption, technological innovations, and increasing use cases like DeFi and cross-border payments are fueling growth.

Q2: Are cryptocurrencies replacing traditional money?

Not yet. They are currently complementing traditional finance, but tokenization and CBDCs suggest a blended future.

Q3: Which regions are leading crypto adoption?

North America, Europe, and Asia lead institutional and retail adoption, while Africa and Latin America are growing rapidly due to remittance and inflation challenges.

Q4: How do regulatory changes impact cryptocurrency markets?

A4: Regulatory developments significantly influence market sentiment, institutional adoption, and overall ecosystem stability.

Q5: What are the primary challenges in cryptocurrency adoption?

A5: Technical complexity, regulatory uncertainty, market volatility, and public perception are key challenges.

Meta Description:

Comprehensive analysis of the global cryptocurrency market, exploring emerging trends, technological innovations, regulatory landscapes, and transformative potential across international financial ecosystems.