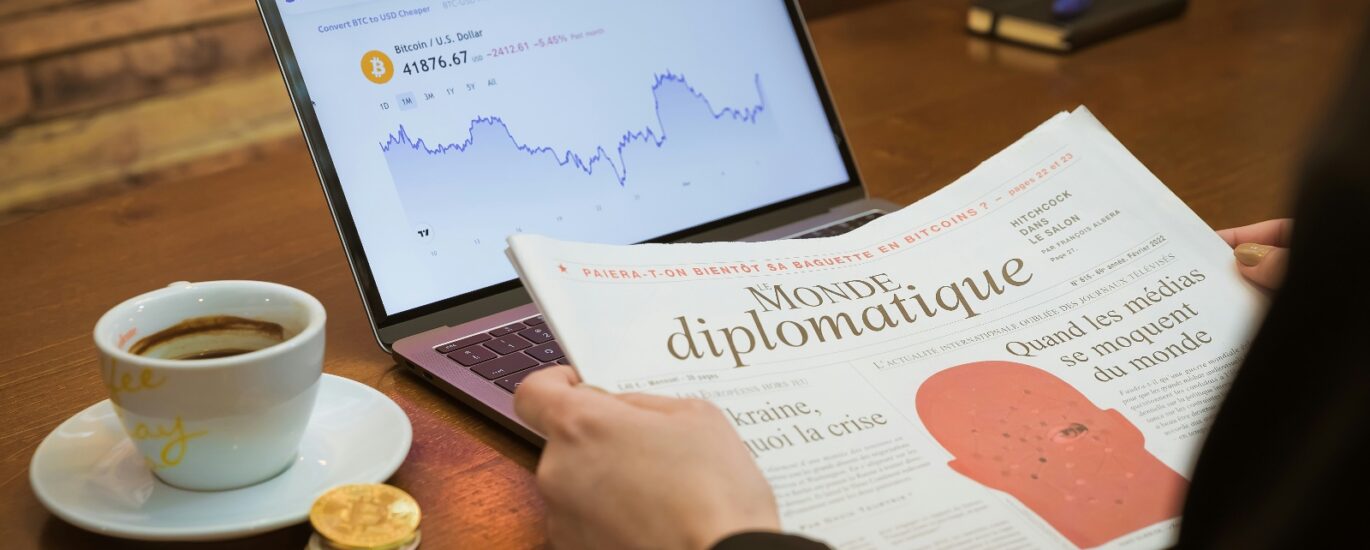

Exploring How Enterprises, Startups, and Global Markets Are Embracing Digital Assets for the Future of Commerce

Every so often, the world of business undergoes a transformation so profound that it reshapes entire industries. The introduction of credit cards in the mid-20th century, the rise of e-commerce in the 1990s, and the global shift to mobile payments in the 2010s are all examples of such turning points. Now, in 2025, we find ourselves in the midst of another revolution: the adoption of cryptocurrency by businesses across the globe.

What was once dismissed as a speculative asset class reserved for tech enthusiasts has matured into a legitimate financial tool used by corporations, startups, small businesses, and even governments. Businesses are not only accepting cryptocurrencies as a form of payment but are also integrating blockchain into their operations, experimenting with tokenized assets, and using digital currencies to unlock new markets.

In just over a decade, cryptocurrency has gone from an experimental idea introduced by Bitcoin in 2009 to a trillion-dollar ecosystem with real-world applications that are transforming how businesses interact with customers, suppliers, and investors. The COVID-19 pandemic accelerated digital transformation, creating fertile ground for businesses to embrace decentralized technologies. Fast forward to today, and companies are finding that crypto adoption is no longer a “nice to have”—it’s quickly becoming a competitive necessity. We stand at a critical inflection point of economic evolution—a transformative moment where cryptocurrency transitions from a speculative technology to a fundamental mechanism of business financial strategy. The year 2025 represents a pivotal chapter in digital economic transformation, characterized by sophisticated technological integration, institutional maturity, and unprecedented business adoption strategies.

The Global Shift Toward Digital Assets

i- The Maturation of Cryptocurrency

- In the early 2010s, businesses hesitated to embrace crypto due to volatility, regulatory uncertainty, and lack of infrastructure.

- By 2025, infrastructure has matured significantly: payment processors, stablecoins, and regulatory clarity have made crypto adoption more viable.

- Crypto is now integrated into point-of-sale systems, e-commerce platforms, and enterprise finance tools.

ii- The Role of Generational Change

- Younger consumers, especially Gen Z and millennials, are more comfortable with digital assets.

- Businesses are adapting to consumer demand, realizing that crypto adoption improves brand perception among tech-savvy audience.

Why Businesses Are Adopting Crypto in 2025

i- Competitive Advantage

Early adopters position themselves as innovators, appealing to forward-thinking consumers and investors.

ii- Financial Efficiency

- Lower transaction fees compared to traditional credit card networks.

- Faster settlement times reduce cash flow bottlenecks.

iii- Global Reach

Crypto eliminates barriers of international banking systems, enabling seamless cross-border trade.

iv- Transparency and Security

Blockchain provides immutable transaction records, reducing fraud and enhancing trust.

v- Employee and Vendor Payments

Businesses are experimenting with crypto payroll and paying international vendors in stablecoins to avoid currency conversion fees.

Real-World Business Use Cases

i- Retail and E-Commerce

- Major online platforms integrate crypto payment options.

- Small retailers in crypto-friendly regions use QR codes for in-store payments.

ii- Hospitality and Travel

Hotels and airlines are tapping into crypto to attract global travelers who prefer digital assets.

iii- Real Estate

Developers accept crypto for property purchases, especially in luxury markets.

iv- Technology Companies

Tech startups are raising capital via tokenized assets and decentralized finance (DeFi).

v- Freelance and Gig Economy

Freelancers are increasingly paid in stablecoins for instant, borderless transactions.

Advanced Cryptocurrency Business Technologies

The sophisticated technological ecosystem enabling business adoption.Technological Characteristics:

- Enterprise-Grade Blockchain Architectures

- Advanced Cryptographic Security

- Intelligent Transaction Protocols

- Scalable Digital Asset Platforms

- Key Technological Components:

- A. Blockchain Business Evolution

- Enterprise Distributed Ledger Systems

- Intelligent Contract Platforms

- Cross-Organizational Interoperability

- Quantum-Resistant Transaction Frameworks

- B. Advanced Cryptographic Innovations

- Enhanced Security Protocols

- Institutional-Level Encryption

- Comprehensive Identity Verification

- Dynamic Risk Management Technologies

Strategic Adoption Mechanisms

Sophisticated Business Cryptocurrency Integration.Comprehensive approaches to digital asset implementation.Adoption Strategy Characteristics:

- Phased Implementation Approaches

- Comprehensive Risk Management

- Strategic Financial Diversification

- Intelligent Asset Allocation

- Adoption Mechanism Components:

- Treasury Cryptocurrency Reserves

- Digital Asset Investment Strategies

- Blockchain-Based Financial Operations

- Advanced Cryptocurrency Governance

Economic Transformation

Reimagining Business Financial Interactions.Cryptocurrency’s profound impact on organizational economic strategies.Economic Transformation Features:

- Borderless Financial Interactions

- Reduced Transaction Complexity

- Enhanced Global Accessibility

- Intelligent Financial Mechanisms

- Transformation Domains:

- Alternative Investment Strategies

- Decentralized Financial Operations

- Global Economic Participation

- Transparent Financial Interactions

In 2025, cryptocurrency adoption in business has moved far beyond hype. What started as a speculative experiment is now a practical financial tool driving efficiency, innovation, and global expansion. From small e-commerce stores to multinational corporations, businesses are realizing that ignoring crypto means falling behind competitors who are already reaping its benefits.

Yes, challenges remain—regulation, volatility, and education—but these obstacles are being addressed as infrastructure improves and governments step in with clearer guidelines.

The future of business is decentralized, borderless, and digital-first. Cryptocurrency isn’t just shaping payments—it’s shaping the entire future of commerce. Business cryptocurrency adoption in 2025 represents a profound technological, economic, and strategic revolution. Digital financial mechanisms emerge as sophisticated tools for reimagining organizational interactions, challenging fundamental assumptions about value, exchange, and economic participation.

We stand at the threshold of a new economic paradigm—a world where business financial systems are more transparent, accessible, efficient, and fundamentally intelligent. Cryptocurrency transcends its initial perception as a speculative technology, becoming a sophisticated mechanism for strategic financial transformation and technological innovation.

The journey of business cryptocurrency adoption is a testament to human creativity, technological brilliance, and our collective capacity to challenge existing financial systems. It represents a powerful narrative of economic empowerment, technological innovation, and the continuous evolution of organizational financial interactions.

FAQs

Q1: Why are businesses adopting cryptocurrency in 2025?

To reduce transaction fees, access global markets, and meet consumer demand for digital payment options.

Q2: What type of businesses are leading adoption?

Retail, real estate, hospitality, tech startups, and freelancers are among the most active adopters.

Q3: Are stablecoins more practical for businesses than Bitcoin?

Yes. Stablecoins provide price stability and are easier to integrate for day-to-day transactions.

Q4: What technologies drive business cryptocurrency integration?

Enterprise blockchain, advanced cryptography, and intelligent transaction protocols are primary technological drivers.

Q5: How transformative is cryptocurrency for businesses?

Cryptocurrency offers potential for global accessibility, reduced transaction complexity, and strategic financial innovation.

Meta Description:

Comprehensive exploration of business cryptocurrency adoption in 2025, analyzing technological innovations, strategic implementation, economic implications, and the transformative potential of digital financial mechanisms.