Exploring How Cryptocurrencies, Tokenization, and Blockchain Are Redefining Global Finance

The global financial system is undergoing a transformation unlike any seen in modern history. For decades, the pillars of finance rested firmly on traditional assets—stocks, bonds, commodities, and fiat currencies regulated by central banks and governments. Yet, in the last fifteen years, a new class of assets has emerged to challenge the very foundations of this structure: digital assets.

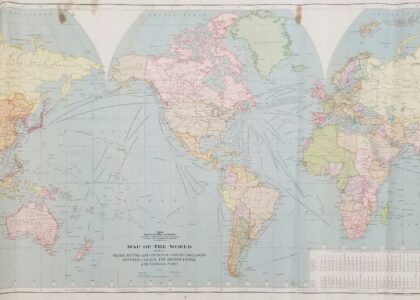

Digital assets—ranging from cryptocurrencies like Bitcoin and Ethereum to tokenized securities, central bank digital currencies (CBDCs), and decentralized finance (DeFi) applications—represent a new frontier in finance. They are not confined by borders, operate on decentralized networks, and thrive in an increasingly digital economy. What once began as an experiment in peer-to-peer electronic cash has now grown into a multi-trillion-dollar market influencing central banks, institutional investors, and everyday users alike.

The rise of digital assets is not merely a financial evolution; it is a societal and technological revolution. They embody the convergence of finance, technology, and human behavior, reshaping how individuals save, spend, invest, and even think about the concept of money. For many, digital assets offer empowerment: access to financial systems for the unbanked, new forms of investment, and opportunities for wealth creation outside traditional banking. For others, they raise concerns about volatility, regulation, and systemic risks.

As we stand in 2025, digital assets have cemented their place in the global conversation. Governments are developing regulatory frameworks; financial institutions are integrating blockchain-based services; and innovators continue to push boundaries with tokenization, NFTs, and new payment solutions. The question is no longer whether digital assets will shape global financial markets—it is how, when, and to what extent. We stand at a critical inflection point in financial history—a transformative moment where digital assets fundamentally restructure our understanding of value, investment, and economic interaction. This is not merely a technological trend but a profound revolution challenging traditional financial frameworks, democratizing investment mechanisms, and reimagining economic participation.

The Origins of Digital Assets

To understand the rise of digital assets, it is important to revisit their roots.

- Bitcoin and the Birth of Crypto (2009): Introduced by Satoshi Nakamoto, Bitcoin was designed as a decentralized currency immune to central bank manipulation. It marked the beginning of blockchain-based financial innovation.

- The Evolution of Altcoins: Following Bitcoin, thousands of other cryptocurrencies emerged, each attempting to improve on aspects like scalability, privacy, or programmability.

- Ethereum and Smart Contracts (2015): Ethereum revolutionized the concept of digital assets by enabling programmable contracts, laying the groundwork for decentralized finance (DeFi) and tokenization.

- The Rise of Stablecoins: With volatility a major hurdle, stablecoins pegged to fiat currencies became a bridge between traditional finance and crypto.

What started as an experiment in digital money quickly became the foundation for a new global asset class.

Opportunities Presented by Digital Assets

Financial Inclusion

Digital assets bridge gaps for billions without access to traditional banking. With just a smartphone and internet, individuals can participate in global finance.

New Investment Avenues

They open opportunities for both retail and institutional investors to diversify portfolios, hedge risks, and access new markets.

Faster and Cheaper Transactions

Blockchain enables cross-border payments without intermediaries, reducing fees and delays.

Transparency and Security

Immutable blockchain records reduce fraud and increase trust in financial transactions.

Innovation in Capital Markets

Tokenization allows fractional ownership of expensive assets, democratizing investment opportunities.

Integration with Emerging Technologies

Digital assets integrate seamlessly with AI, IoT, and metaverse ecosystems, paving the way for futuristic economies.

Technological Infrastructure

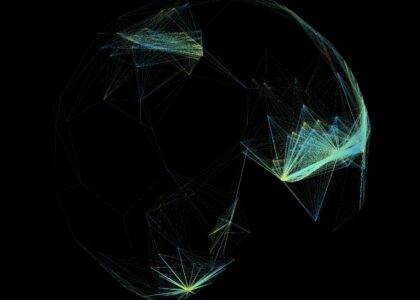

Advanced Digital Asset Foundations.The technological ecosystem enabling digital asset emergence.Technological Characteristics:

- Blockchain Architecture

- Cryptographic Security Mechanisms

- Decentralized Network Protocols

- Intelligent Transaction Systems

- Key Technological Components:

- A. Blockchain Evolution

- Distributed Ledger Technologies

- Smart Contract Platforms

- Interoperability Protocols

- Scalable Network Architectures

- B. Cryptographic Innovations

- Advanced Encryption Technologies

- Secure Transaction Mechanisms

Market Evolution

Digital Asset Market Dynamics.The transformation of investment landscape.Market Characteristics:

- Diversified Asset Categories

- Global Investment Accessibility

- Intelligent Trading Mechanisms

- Real-Time Value Assessment

- Digital Asset Categories:

- Cryptocurrencies

- Tokenized Real-World Assets

- Decentralized Finance Instruments

- Governance Tokens

- Synthetic Assets

Investment Mechanisms

Sophisticated Investment Strategies.Digital assets introduce revolutionary investment approaches.Investment Characteristics:

- Fractional Ownership

- Automated Trading Platforms

- AI-Driven Investment Strategies

- Dynamic Risk Management

- Advanced Investment Features:

- Algorithmic Trading

- Intelligent Portfolio Management

- Sentiment-Driven Investment Mechanisms

- Cross-Asset Correlation Analysis

Institutional and Government Involvement

- Banks and Financial Institutions: Many major banks now offer crypto custody services, trading desks, and blockchain-powered payment systems.

- Governments and CBDCs: CBDCs are seen as a way to modernize payment systems while retaining monetary control.

- Corporate Adoption: Companies like Tesla and PayPal integrate digital assets into business models.

Institutional involvement provides legitimacy but also accelerates the need for clear regulations and infrastructure.

The rise of digital assets represents one of the most significant shifts in financial history. What began as an experiment with Bitcoin has grown into a global financial ecosystem, spanning cryptocurrencies, stablecoins, tokenized assets, and CBDCs.

Opportunities are vast—financial inclusion, efficiency, and innovation—but challenges remain equally pressing, from volatility to regulation. The integration of digital assets into global markets is not a question of “if” but “how quickly and effectively.”

For investors, businesses, and governments, understanding this transformation is no longer optional—it is essential. The future of finance is digital, and digital assets are at its core. The rise of digital assets in global financial markets represents a profound technological, economic, and social revolution. Digital investment mechanisms emerge as powerful tools for reimagining economic interactions, challenging fundamental assumptions about value, investment, and financial participation.

We stand at the threshold of a new economic paradigm—a world where financial systems are more transparent, accessible, efficient, and fundamentally democratic. Digital assets transcend their initial perception as speculative technologies, becoming sophisticated mechanisms for economic transformation and technological innovation.

The journey of digital assets is a testament to human creativity, technological brilliance, and our collective capacity to challenge existing financial systems. It represents a powerful narrative of economic empowerment, technological innovation, and the continuous evolution of human economic interaction.

FAQs

Q1: What are digital assets?

Digital assets are financial assets created and managed on blockchain networks, including cryptocurrencies, stablecoins, tokenized assets, NFTs, and CBDCs.

Q2: Why are digital assets important in global markets?

They increase financial inclusion, create new investment opportunities, and modernize global transactions.

Q3: How do digital assets differ from traditional investments?

Digital assets offer increased accessibility, transparency, fractional ownership, and technological innovation compared to traditional investment mechanisms.

Q4: What technologies drive digital asset development?

Blockchain, cryptography, artificial intelligence, and distributed network technologies are primary technological drivers.

Q5: What are the primary challenges in digital asset investment?

Regulatory uncertainty, technological complexity, market volatility, and public perception remain key challenges.

Meta Description:

Comprehensive exploration of digital assets’ emergence, analyzing technological innovations, market dynamics, investment strategies, and the profound transformation of global financial landscapes.