Exploring the Milestones, Challenges, and Opportunities Defining Digital Assets in a Transforming World

The story of cryptocurrency has always been about transformation. In less than two decades, what started as an experiment in peer-to-peer electronic cash has grown into a global phenomenon that touches nearly every corner of finance, technology, and commerce. As we step into 2025, the world of digital assets is more dynamic than ever—brimming with opportunities, riddled with challenges, and positioned at the crossroads of innovation and regulation.

Cryptocurrencies are no longer the speculative side projects they once were. Bitcoin, Ethereum, and thousands of other digital currencies have established themselves as legitimate players in global finance. The conversations around them have shifted: governments are now drafting digital asset policies, corporations are exploring blockchain solutions, and investors of all sizes—retail and institutional alike—are embracing crypto as a critical part of their portfolios.

But while crypto’s relevance has grown, so too have the complexities. 2025 is a pivotal year. On one hand, the global market has matured: regulations are becoming clearer, technology is scaling, and mainstream adoption is increasing. On the other hand, volatility, hacks, environmental concerns, and geopolitical tensions still weigh heavily on the industry. We stand at a pivotal moment in financial history—a transformative era where cryptocurrency transcends its initial perception as a speculative instrument and emerges as a fundamental mechanism of global economic transformation. This is not merely a technological trend but a profound revolution challenging traditional financial frameworks, democratizing economic participation, and reimagining value exchange.

The Market Landscape in 2025

The global cryptocurrency market has surpassed trillions of dollars in capitalization once again, rebounding from past crashes and showing resilience as an asset class. Key features include:

- Market maturity: Bitcoin still dominates as digital gold, but altcoins and stablecoins have captured massive market share.

- Greater institutional involvement: Hedge funds, pension funds, and sovereign wealth funds are now investing directly in crypto.

- Increased mainstream adoption: Payments, remittances, NFTs, and tokenized assets are part of everyday transactions.

- Integration with traditional finance: Crypto ETFs, derivatives, and custody services are widely available.

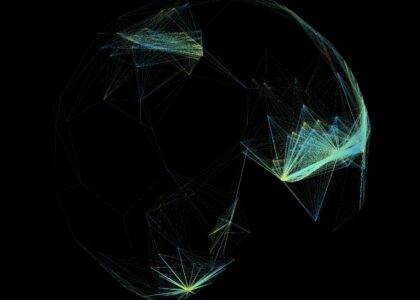

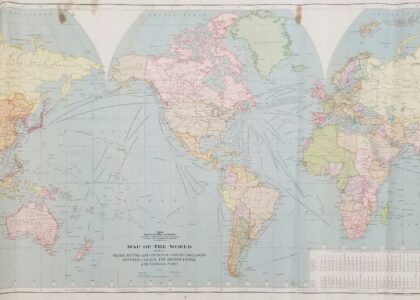

Regional Dynamics in 2025

North America

- The United States has established clearer crypto regulations, focusing on consumer protection and anti-money laundering measures.

- Canada leads in Bitcoin ETFs and mining operations.

- North America remains the largest institutional hub for crypto.

Europe

- The EU’s Markets in Crypto Assets (MiCA) framework is fully in force, making Europe one of the most harmonized regions for crypto activity.

- European fintechs are leading in payments and tokenization projects.

Asia

- Japan continues as a regulated innovation hub.

- Singapore remains the crypto-friendly gateway to Asia.

- China, while restrictive, has doubled down on CBDC adoption.

Latin America

- Countries like Brazil, Argentina, and El Salvador are embracing Bitcoin and stablecoins as hedges against inflation.

- Remittances via crypto are booming.

Africa

- Nigeria, Kenya, and South Africa lead adoption, with crypto being a tool for financial inclusion.

- Peer-to-peer crypto markets dominate due to banking limitations.

Opportunities in 2025

- Global payments: Cross-border transactions are cheaper and faster with stablecoins.

- Financial inclusion: Billions of unbanked people can now access crypto wallets.

- Wealth preservation: In inflation-prone economies, crypto is a store of value.

- Innovation in business: Companies use blockchain for supply chain management, identity verification, and decentralized data storage.

Market Structure

Cryptocurrency Market Composition.The market demonstrates unprecedented sophistication.Market Characteristics:

- Diversified Asset Ecosystem

- Institutional-Grade Infrastructure

- Advanced Trading Mechanisms

- Regulated Digital Asset Platforms

- Cryptocurrency Categories:

- Established Cryptocurrencies

- Institutional Digital Assets

- Tokenized Real-World Assets

- Governance and Utility Tokens

- Regulatory-Compliant Stablecoins

Investment Landscapes

Sophisticated Investment Mechanisms.Cryptocurrency investment becomes institutionally mature.Investment Characteristics:

- Advanced Risk Management

- Diversified Investment Products

- Institutional Portfolio Allocation

- Algorithmic Trading Platforms

- Investment Innovation:

- Cryptocurrency Derivatives

- Tokenized Investment Funds

- AI-Driven Trading Strategies

- Automated Portfolio Management

Global Economic Impact

Transformative Economic Potential.Cryptocurrency reshapes global economic interactions.Economic Transformation Domains:

- Financial Inclusion

- Decentralized Economic Networks

- Alternative Financial Mechanisms

- Global Value Exchange Systems

- Potential Economic Implications:

- Reduced Transaction Costs

- Enhanced Economic Accessibility

- Transparent Financial Infrastructure

- Borderless Economic Participation

As of 2025, the global crypto market stands as a mature, complex, and transformative financial ecosystem. It is no longer a fringe experiment—it is an integrated part of the world economy. With institutional adoption, regulatory clarity, and technological breakthroughs, crypto has proven its staying power.

Yet, challenges remain. Volatility, fragmented regulations, and security risks are hurdles the industry must overcome. But if the past decade has taught us anything, it’s that the crypto market is resilient, adaptive, and always evolving.

The future of digital assets isn’t just about replacing traditional money—it’s about building a new financial architecture that is more inclusive, transparent, and global. The global cryptocurrency market in 2025 represents a profound technological, economic, and social revolution. Digital assets emerge as a sophisticated, integral component of the global financial ecosystem, challenging fundamental assumptions about value, exchange, and economic interaction.

We stand at the threshold of a new economic paradigm—a world where financial systems are more transparent, accessible, efficient, and fundamentally democratic. Cryptocurrency transcends its initial perception as a speculative technology, becoming a powerful mechanism for reimagining economic possibilities.

The journey of digital assets is a testament to human creativity, technological innovation, and our collective capacity to challenge existing systems. It represents a powerful narrative of economic empowerment, technological brilliance, and the continuous evolution of human economic interaction.

FAQs

Q1: How big is the global crypto market in 2025?

The market capitalization has rebounded into the trillions, with Bitcoin and Ethereum maintaining dominance while altcoins and stablecoins continue to grow.

Q2: Are governments supporting or resisting crypto in 2025?

Both. Some embrace it with regulations and CBDCs, while others remain cautious or restrictive.

Q3: What is the role of stablecoins in 2025?

Stablecoins serve as the backbone for digital payments and DeFi, bridging crypto with traditional currencies.

Q4: How will regulatory changes impact cryptocurrency markets?

Enhanced regulatory frameworks are expected to increase market stability and institutional confidence.

Q5: What are the primary challenges in cryptocurrency adoption?

Technical complexity, regulatory adaptation, and public perception will continue to be key challenges.

Meta Description:

Comprehensive forward-looking analysis of the global cryptocurrency market in 2025, exploring technological innovations, market dynamics, regulatory landscapes, and transformative economic potential.